Why Is The $ Used Logon Service Account?

If you lot're running a small-scale business and you need help keeping the books, you're in luck. Minor-business accounting, once pretty much divers past the QuickBooks and Peachtree desktop packages, has blossomed on the Spider web and diversified. You lot tin discover a wealth of services that will meet your business's accounting needs, from full-featured accounting to payroll, expense accounts, invoicing, and more.

All of these services run in a browser, then you tin crisis numbers from merely well-nigh any Web-connected calculator, and many take smartphone companion apps. Several offer integration features that let you take advantage of other sites and services–or fifty-fifty desktop software. All promise financial-establishment-caliber safeguards for your data, which is probably better protected at an industrial data center than on near home PCs.

Here'due south a look at five accounting sites for pocket-sized businesses. While all will help yous proceed track of income and expenses, each 1 has specific features that might brand it a practiced fit for your accounting needs and preferences. Virtually have very basic free versions or 30-day gratis trials that will let yous dip your toe into the water, also.

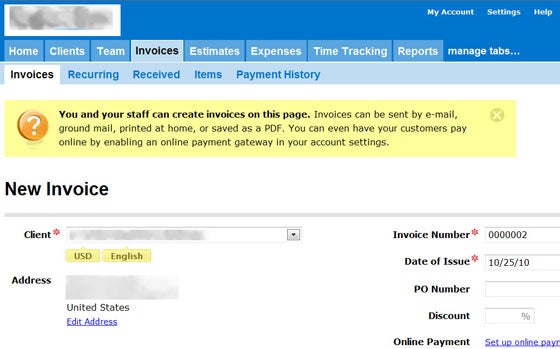

FreshBooks

Although primarily an invoicing application, FreshBooks also offers expense- and time-tracking features that will appeal to small-scale, service-oriented businesses. Fifty-fifty the free version gives you lot a subdomain on the FreshBooks site (in the format mydomain.freshbooks.com), which y'all can customize with a logo and colors. You can import expense data from bank and credit carte accounts–but but by exporting it manually to a CSV file, which you lot must then reorganize so that your fields represent to FreshBooks' import format.

FreshBooks is a expert fit for service-oriented companies.

FreshBooks will likewise appeal to small businesses that are willing to pay to outsource snail-mail invoicing: For between $0.99 and $i.39 a nib (depending on how many bills you mail each calendar month), FreshBooks will create and mail invoices for you, complete with payment stubs and return envelopes.

It will too send out east-mail invoices and help you fix online payment receipt via any one of x supported online payment services, including PayPal. You tin collect and sync FreshBooks data via Android, BlackBerry, and iPhone apps, too.

FreshBooks' gratuitous version limits yous to one user business relationship and no more than three clients; it too puts its make on e-mail invoices. Upgrades ranging from $20 to $40 permit you add clients and squad functionality. FreshBooks doesn't actually nib itself every bit a complete accounting service, however. Rather, it encourages you to apply it for 24-hour interval-to-twenty-four hours time tracking and invoicing, and information technology suggests that you periodically export totals to other products for calculating taxes and performing other accounting functions.

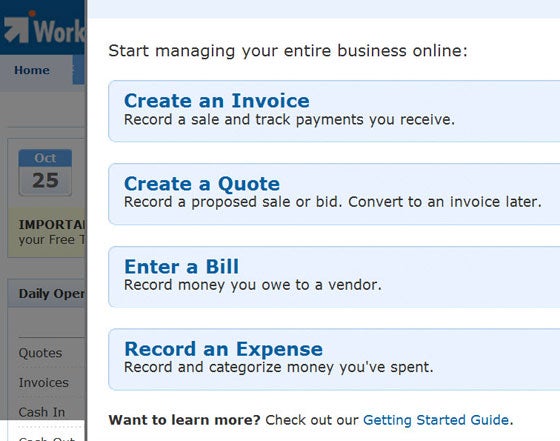

WorkingPoint

This capable service seems directed primarily at companies that carry inventory, equally information technology lets you import inventory items via CSV file and offers billing options that you don't see in near small-business Spider web services. Merely it has lots of other helpful automation functions, besides, including the ability to download and import transaction data from bank accounts and credit cards, too as support for manual import of contacts (via CSV or VCard files). As y'all import transactions, yous identify the Schedule C line particular where they'll get, which will help enormously at tax time.

WorkingPoint is a convenient choice for those who are only getting started.

WorkingPoint does a very good job of making its many features less intimidating for newcomers, providing step-by-step instructions everywhere as well as complete assist files. Also reassuring is the e'er-present orangish Support tab on the correct side of each page.

These features aren't costless: Afterwards a xxx-twenty-four hour period trial, you lot must pay either $9 a month for up to x invoices, or $20 a month for unlimited invoices, tax reports, back up for PayPal payments and recurring invoices, and the ability to give other users admission to your account.

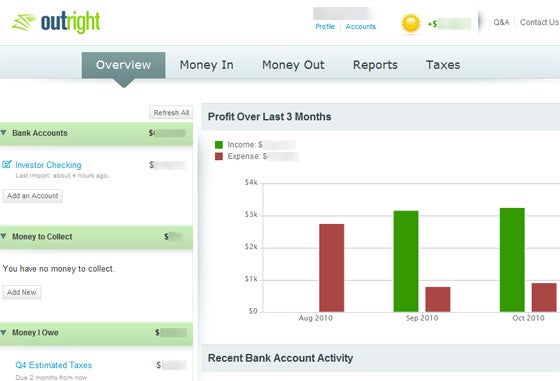

Outright

This gratuitous bookkeeping service lacks some of the features you lot get in near bookkeeping packages–it can't create an invoice, for example–just it does make the basics of expense and income tracking easy. More than important, it tackles a trouble that sends many self-employed people into the arms of a pricey auditor: figuring out quarterly tax liability.

Outright supports downloads for banking company account and credit card transactions, which it automatically channels into income (Money In) and expense (Money Out) registers. You delete the transactions that aren't business related, and then assign Schedule C categories to those that are. Based on this data, Outright figures out what you owe the federal authorities each quarter. Y'all're on your own for state taxes, however.

Outright's reports feature uses the same Coin In/Out data to generate several nifty-looking charts of your profit-and-loss statements, expenses by category, and the similar.

Outright offers bank and credit card support, and helps you with quarterly federal taxes.

During tax flavour last twelvemonth, Outright offered a paid service for filing 1099 forms (statements documenting payments to independent contractors). Most Outright users probably wouldn't demand that service, though. Outright really is for the smallest of small businesses: self-employed individuals who want an piece of cake-to-use tool to rails how well their concern is doing and how much they take to send Uncle Sam every quarter.

Next folio: A practiced choice for multiple-currency support, plus Web-based QuickBooks

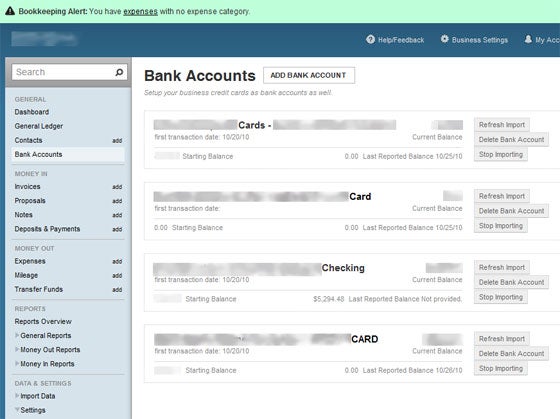

Less Accounting

Excellent data importing, strange linguistic communication and currency features, and a slew of customization options are among the selling points for the full-featured Less Accounting service, although many of those functions are available only with the pricier plans. Less Accounting has 5 pricing options, starting with a free version that limits you to 5 invoices and five expense items a month and doesn't support banking concern transaction downloads.

A $12-a-month version lifts the invoice and expense restrictions, only withal doesn't back up nightly bank and credit card transaction downloads. Plans priced at $20 and $24 a month heap on additional features; and if yous desire to get the services of a human bookkeeper, Less Accounting will provide that for $300 a calendar month. All accounts create a custom subdomain (in the format mydomain.lessaccounting.com) with a dashboard-mode landing page that appears when you log in.

While somewhat pricey, Less Accounting has modules that make information technology a skillful choice for businesses with customers in unlike countries, including multiple-currency back up and the pick to customize forms by providing your own translations for standard invoice and proposal terms. Most plans include mileage logs; all allow you import contacts from Gmail and Outlook.

Less Accounting supports multiple currencies, a corking feature if you perform work in multiple countries.

The service integrates with a number of others that provide functionality y'all don't get inside Less Accounting, including PayPal payment receipts, CRM features (HighRise), and a snail-mail service (Postal Methods) for sending invoices and proposals. Those add together-ons, along with Less Accounting's own modular approach to pricing, arrive suitable for a fast-growing business with apace changing needs.

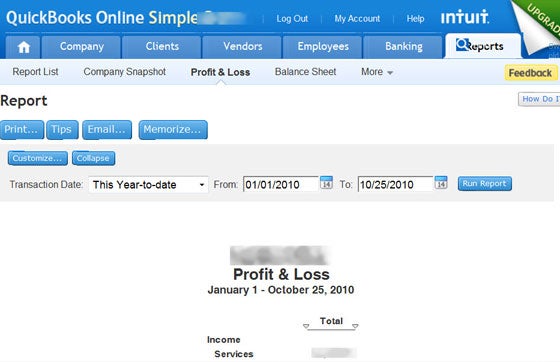

QuickBooks Online

Intuit may non be happy to see the Web swallow away at its flagship desktop app, but information technology isn't standing idly past. In the terminal yr the visitor has significantly upgraded and improved its QuickBooks online offerings, implementing a badly needed user-interface overhaul and introducing new features.

The QuickBooks Online upgrade path is articulate: The gratuitous (and surprisingly capable) Uncomplicated Start limits you to xx customers and a express set of reports; it may be worth investigating for former Quicken Home & Business organization Online users seeking a new home since Intuit folded all Quicken Online services into the strictly consumer-focused Mint.com.

QuickBooks Simple Start tin can practice the trick if you're cocky-employed and don't need online banking support.

For $10, QuickBooks Online Basic offers xl reports and lets your auditor log in, but you lot'll have to upgrade to the $35-a-month QuickBooks Online Plus for online banking support and a slew of custom invoicing, billing, and expense-tracking options (including customer access for sure functions). Payroll and credit carte du jour payment support are available to all customers regardless of program, equally actress-cost options.

QuickBooks Online's handsome user interface and task-focused arroyo to bookkeeping put it on a par with the competition, merely the paid versions are pricey and inventory back up is sketchy. The gratuitous Simple Start, nevertheless, is a real jewel that can hands meet the needs of a self-employed professional who wants to create invoices and proceed an middle on the lesser line, and who doesn't particularly care about online banking support.

Who Should Use These Services?

Web-based accounting services for modest businesses are condign increasingly sophisticated and diversified. The ability to access business relationship info and create invoices from any PC–or, increasingly, from a smartphone–makes them especially useful for businesses that return services on customer sites, but others can likewise benefit from these offerings.

For example, for individuals who are only starting out and demand to keep expenses down, free services such as Outright and QuickBooks Simple Start–perhaps even in tandem–can be a godsend. Outright offers basic tax help that yous don't go elsewhere, with transaction download support that competitors make you pay for; QuickBooks, meanwhile, has good invoicing and reporting features for upwards to 20 customers.

Simply for but pennies (or peradventure dimes or quarters) a day, paid services such as WorkingPoint, with tools to handle billing for inventory, and Less Accounting, with its modular approach and many add-ons, can deliver existent value. Both as well save you data entry thanks to transaction download support; Less Accounting, on its higher-priced plans, especially shines in that respect. FreshBooks' snail-mail invoicing service could be worthwhile if y'all seek to avoid the tiresome task of printing, stamping, and sending bils via U.S. mail. At the higher finish, QuickBooks Online'southward paid services cater to growing businesses with complicated payroll issues, and to anyone who can utilize sophisticated reports to tweak business plans. Less Bookkeeping's higher-end offerings will help people who practise business abroad.

These five services cater to anybody seeking to offload or at least simplify day-to-twenty-four hours bookkeeping tasks as inexpensively as possible so that employees can concentrate on what they make money doing. Yous may notwithstanding demand an accountant to look over the big picture of your tax situation, merely these services can empower you to continue relevant information organized and handy on your own.

Why Is The $ Used Logon Service Account?,

Source: https://www.pcworld.com/article/504297/online_accounting_quickbooks_freshbooks.html

Posted by: kisertany1937.blogspot.com

0 Response to "Why Is The $ Used Logon Service Account?"

Post a Comment