Do I Pay New Jersey Sales Tax On Service

Occupancy Revenue enhancement Collection and Remittance in the State of New Bailiwick of jersey

As of October 1, 2018, New Jersey has applied Sales Tax and the Country Occupancy Fee on charges associated with the rental of transient accommodations. In practise, what this ways that landlords who hire out rooms transiently on online marketplaces for less than xc days owe taxes.

In the original nib, it was worded such that landlords who rent directly (either on their own or with the adjutant of referral marketplaces/websites) were subject to the tax. Also, if you rented the property through a licensed realtor, you were besides exempt from the tax.

A subsequent follow up nib was passed in 2019 (A4814) that repealed the tax on landlords who rent properties on their own (exterior of online marketplaces). The exemption only applies if you rent 1 or 2 homes.

These are the exceptions that may apply to you:

- The rental menstruum is ninety days or more.

- The rental was obtained through a licensed Realtor.

- The landlord rents 1 or 2 properties.

A detailed certificate describing all the state rules can be establish here.

Statewide Taxation Rate

The post-obit taxes need to be collected. These 2 taxes are consistent with what hotels are charged equally well.

- Occupancy Fee: v%

- Sales Tax: 6.625%

- Total: 11.625%

In well-nigh all cases, the two taxes above utilise. The constabulary allows some municipalities to alter the state rates.

City Special Rates

The land legislation provides the ability of some local municipalities to charge their own transient taxes. Municipalities may amend or adopt an ordinance to impose the post-obit additional taxes on charges for transient accommodations:

- Municipal Occupancy Tax, Sports and Entertainment Facility Tax (Millville)

- Atlantic City Luxury Tax (Atlantic City)

- Atlantic City Promotion Fee (Atlantic City)

- Cape May County Tourism Tax and Assessment (Cape May County)

- Hotel Occupancy Revenue enhancement (Elizabeth, Newark, and Jersey City).

If you lot property is located amongst the jurisdictions mentioned above, so local taxes could be coming your style in the future. Equally of March 2019, only one municipality has moved to amend their own ordinances (Elizabeth). This is the jurisdiction that has adopted their own accommodations taxes.

Elizabeth – Special Taxation Charge per unit

The following taxes demand to be collected according to these rates.

- State Occupancy Fee – i%

- Sales Tax – 6.625%

- Elizabeth Occupancy Tax – 6%

- Full: 13.625%

As a outcome of charging its own occupancy tax, the state occupancy tax rate gets reduced to 1%. The effect of this ordinance is that the tax rate for Elizabeth is ii% higher than the rest of the state.

Do I Demand To Pay?

Most landlords are non required to pay the tax unless they rent more 2 properties. Also, rentals obtained from a licensed existent estate agent are exempt. If you use any online service that charges payments on your behalf you lot are good. These companies are required to charge and submit the payments on your behalf. These services include companies such every bit Airbnb and Booking.com.

Exempt Rental Activity – Do not submit taxes

-

Licensed Real Estate Agent -

Airbnb/VRBO -

Booking.com -

Other sites that charge guest on your behalf -

Landlord rents directly or by referral

The most common reason why yous would demand to file and pay the taxes is if you lot rent more than ii backdrop.

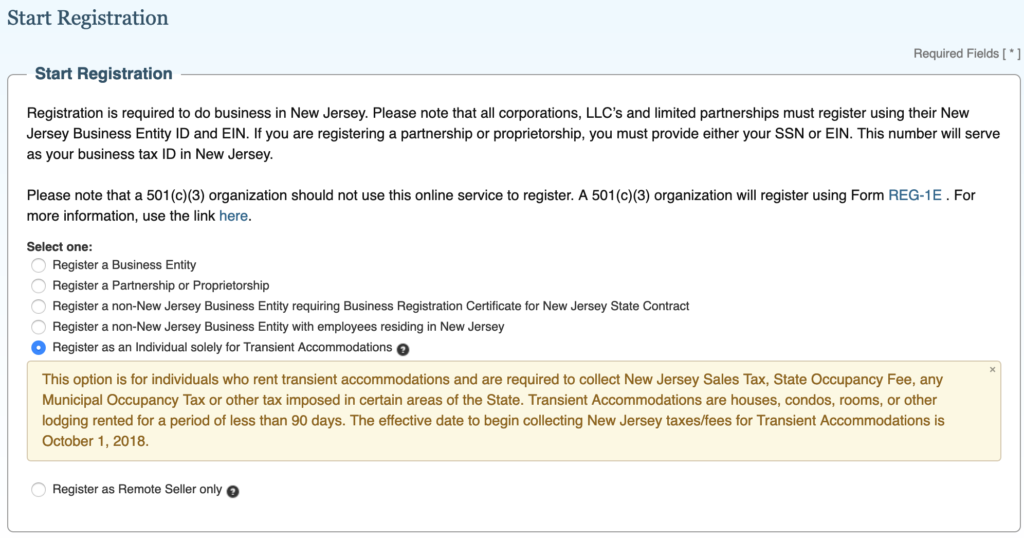

How Do I Register My Property?

You can register your property at the New Jersey state website that provides for business concern registration. Notation that even if your local municipality has chosen to charge its own taxes (equally mentioned higher up), yous would even so ship the money to the country. The country takes intendance of the distribution of the money to the city on your behalf. This is more convenient than other states that may require county or metropolis level registration.

Use the link beneath:

State of New Jersey Business Registration

Also, skilful news you don't really need to take a partnership, LLC or other business entity to use this site. There is an entry specifically designated for homeowners as listed evidence here.

How Practise I Pay?

In that location is a land website where you can submit your payments:

Hotel and Motel State Revenue enhancement Login

Earlier you tin can submit your payments, register your property as explained in a higher place. The state will provide paperwork to yous that confirms your registration forth with an account Pivot.

Do I Pay New Jersey Sales Tax On Service,

Source: https://www.vacationlord.com/nj/

Posted by: kisertany1937.blogspot.com

0 Response to "Do I Pay New Jersey Sales Tax On Service"

Post a Comment